Bookkeeping Function

Record financial transactions and generate financial snapshots.

Introduction

The bookkeeping function allows users to accurately record financial transactions into a well-organized ledger, with tools to efficiently and effectively track and manage their financial information.

This includes recording debits and credits in the general ledger, managing receipts and payments, creating journals, and maintaining a chart of accounts. It also provides users with the ability to generate financial snapshots for better insight into their business.

Features

Chart of Accounts

The chart of accounts is a list of all the financial accounts in your organization. It includes various types of ledgers, such as tax-allowable, currency, and purpose-specific accounts.

The COA is used to create financial statements, like the Profit & Loss Statement, and it has a hierarchical structure with lower-level nodes related to their parent nodes.

Cash & Financial Accounts

Cash and financial accounts are current accounts and petty cash in a business, which are used as a payment method during payment processing. You can define custom fee preset, handy tools during payment processing.

Prepayment can be used as one of the Cash and Financial Accounts options, allowing transactions to occur as charges occur and facilitating the reconciliation process prior to closing.

Journal Entry

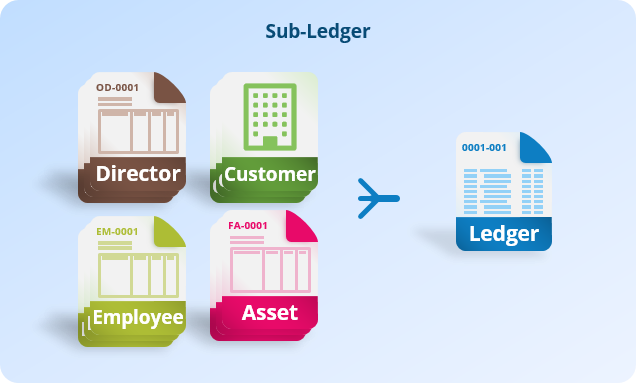

Journal entries are used to record financial transactions, and they can be recorded by time resolution rather than just by day.

The journal supports sub-ledgers for directors, customers, vendors, employees, and other entities. It allows you to associate journal entries with invoices, projects, and other business applications, and it also allows for post-closing adjustments to previously closed periods.

Payment Processing

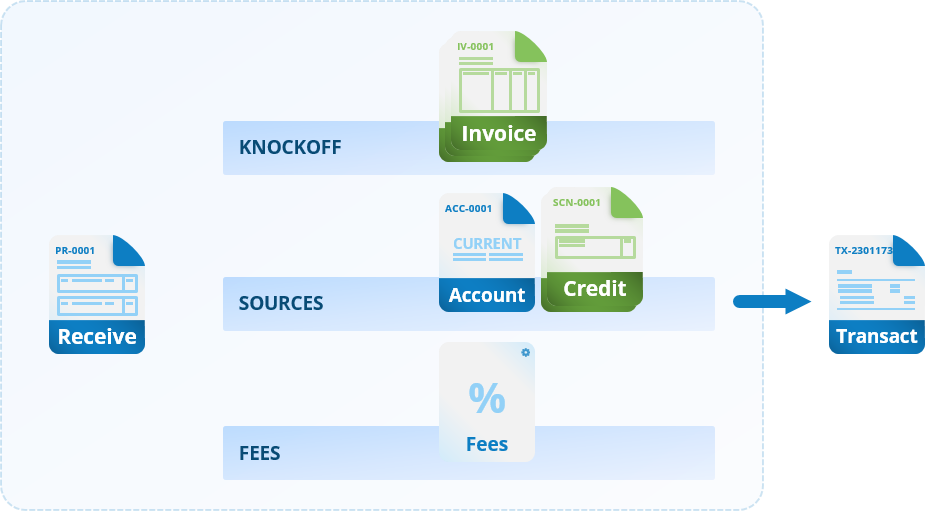

Payment processing is the process of making payments to knock off against documents, like invoices. It can be applied to multiple invoices and in varying amounts.

If there is an overpayment, a credit note or deposit can be easily created. Payment can be made using a combination of different payment sources, including cash and bank transfers, as well as debit/credit notes. Transaction fees can be applied using predefined preset or custom rates.

Bill Payments

Bill payments are used to make payments for utility expenses and other invoice-less charges.

They are self-contained documents that can be duplicated regularly, with most details remaining the same and only the usage value changing each cycle. Preset transaction fees can be set to apply automatically when making payments for a bill. Payments can be marked as confirmed (not paid) or complete (fully paid), bypassing the accounts payable ledger and streamlining the transaction.

Customer Deposits

Customer deposits are documents used to request payment from a customer and to record the balance of what has been spent. They can be applied to future invoices or returned to the customer if allowed by the business.

Highlights

Powerful Financial Project Tool

Draft Status feature allows users to preview financial projections and make changes before committing to a transaction. With this feature, users have greater control and flexibility over their businesses.

The Draft Status is applied to all documents initially, giving users the option to keep them in draft mode until they are ready to be confirmed. This reduces the risk of errors and uncertainties, while still providing the ability to estimate future positions.

Advance Payment Processor

Our payment processing feature is designed to make knocking off invoices as easy and efficient as possible. You can pay employees, statutory bodies, and dispose of fixed assets using the same interface and process.

With the ability to use multiple payment sources and knock off multiple invoices at once, you have complete control over your payments. Plus, the system’s consistent performance and ease of use make it easy to master and manage your business.

Processes

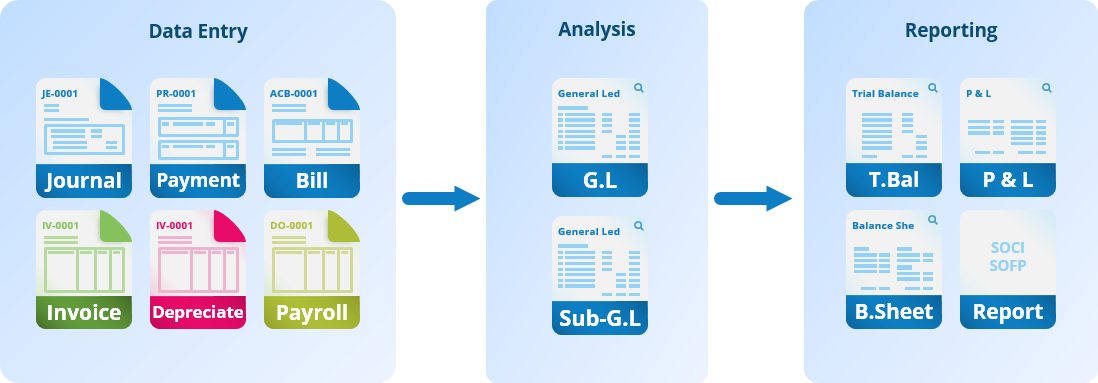

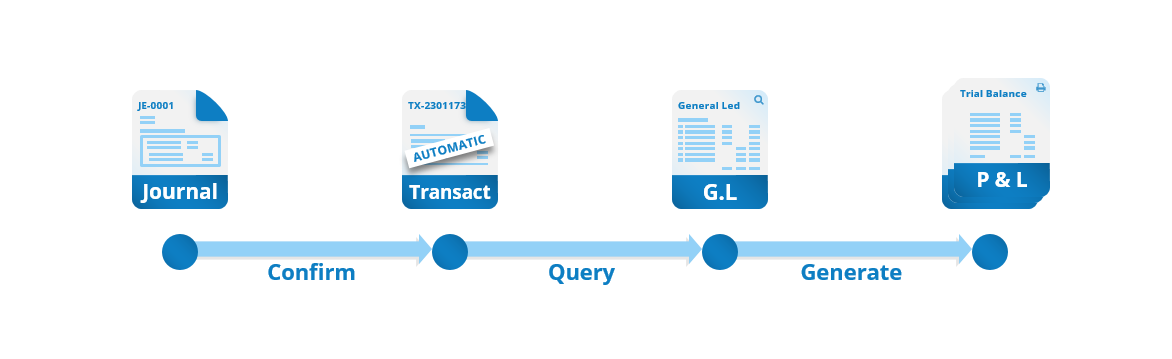

Bookkeeping to Financial Snapshot

Bookkeeping is the process of keeping track of financial transactions in your organization. It involves recording transactions in a ledger, or a list of accounts and their balances, and producing financial reports.

The process typically begins with creating a journal entry, which is a record of every financial transaction. These journal entries are automatically transferred to the general ledgers.

The next step is to reconcile financial accounts, which involves matching the balances in the general ledger with the balances in your external financial statements.

After reconciling the accounts, you can generate financial reports such as a profit and loss statement or a balance sheet.

Other tasks involved in bookkeeping may include calculating asset depreciation, creating provisions for taxes and expected future expenses, and making accruals for unpaid expenses or revenue.

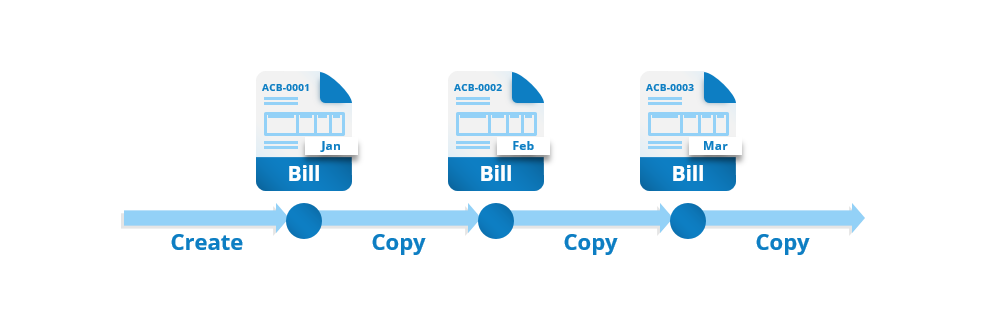

Paying Utility Bills

The process of creating and paying bills in Cloudby Business Suite is straightforward and efficient. When a user receives utility bill, they can simply create a new bill document on the system.

Once the bill is prepared, the user can proceed to make the payment and mark the bill as paid. User also have the options to pay later by marking the bill as pending.

The payment method can be chosen from the list of available Cash and Financial Accounts, and any applicable transaction fees can be automatically accounted for using predefined or custom amounts.

For subsequent billing cycles, the user can easily copy the previous bill, update the relevant fields, such as the date, bill number, and itemized amounts, and then continue the payment process with just a few clicks. This helps to streamline the process and reduces the time and effort required to manage bills.

Receiving Payment

To receive payment, you need to create an invoice and send it to your customer. The invoice should include your customer’s details, a list of the items or services being charged, and the receiving accounts. Once you’ve sent the invoice, the transaction details will be recorded in the accounts receivable ledger

To process the payment, you’ll need to create a receipt using the Receive Payment function. Select the relevant invoices to be knocked off and choose the receiving accounts being used. You can knock off multiple invoices at once and combine multiple receiving account in a single transaction. You can also select or and customize transaction fees as needed. The receipt will remain in a pending state until you confirm that the payment has been received in your account. Once that’s done, mark the receipt as complete.

*This requires subscription to Sales Module

Cycle of Credit Notes

*This section requires subscription to Sales Module with Advance Order Management

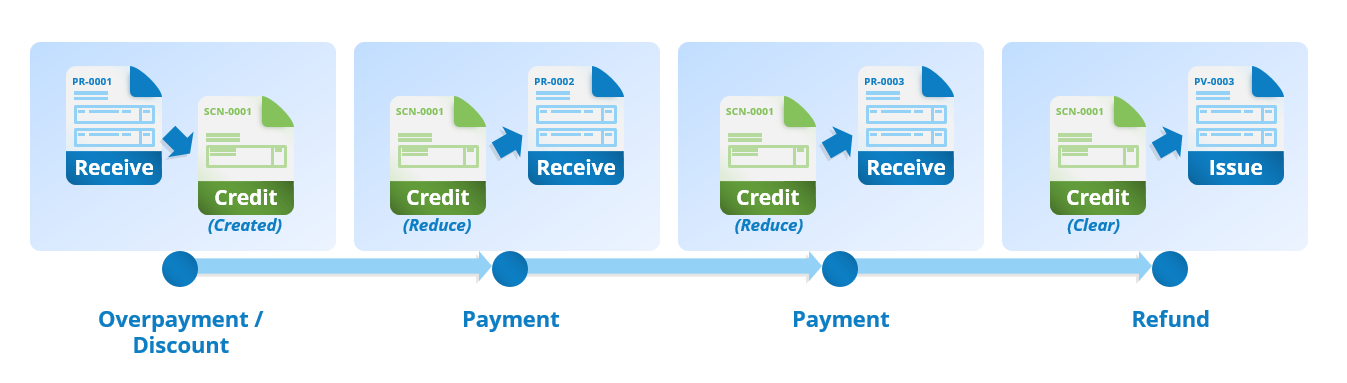

A credit note is used when there is a reduction in the amount of an invoice, such as in the case of a discount or a return or refund. It is a document that records the excess amount of money that a customer has paid. Credit notes can be created from an existing invoice or under the sales module, and they contain information about the associated order, the customer, the line items, and the reason for the credit (such as overpayment, discount refund, or return/refund).

Once a credit note has been confirmed, the amount is posted to the account payable. From there, the credit note can be exercised in 3 ways: it can be used to knockoff future invoices, returned to the customer, or used to contra a vendor.

The deduction of a credit note is progressive, meaning that a large credit note can be used to knock off multiple invoices over time, and maybe the balance could then be return to customer.

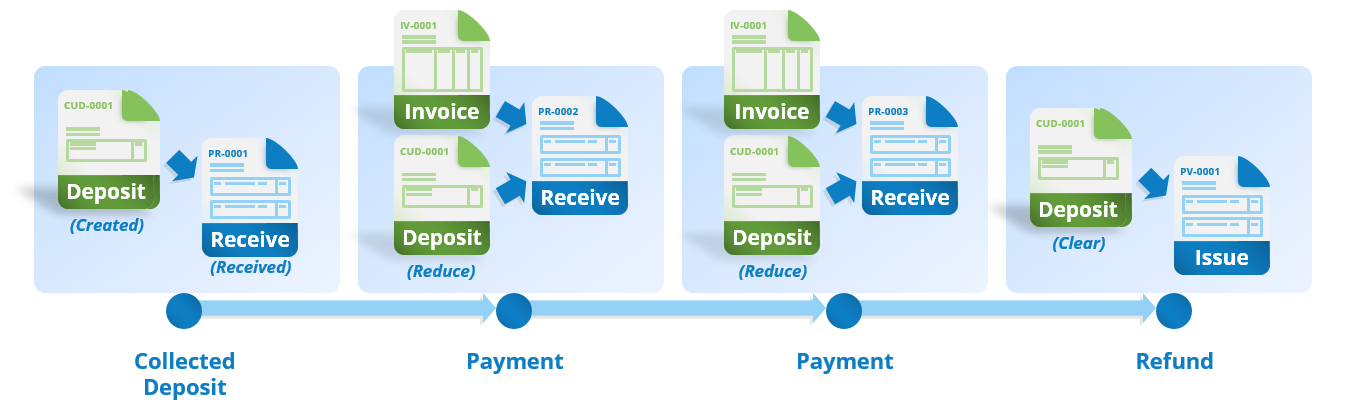

Cycle of Advance deposit

The process of using an advance deposit starts with creating a new advance deposit document in the Payment Receive function. After selecting the customer, you can add the new advance deposit as a payment item and insert the amount to be deposited. The advance deposit is then recorded in the customer’s deposit ledger.

From this point, the advance deposit can be used in a similar way to a credit note. It can be applied to future invoices, returned to the customer, or used to offset a vendor payment. The amount in the advance deposit can be used progressively, meaning it can be applied to multiple invoices or payments over time.

*This section requires subscription to Sales Module

Learn More

Tours

- Bookkeeping & Automation

- Tips to do thing and that

Tutorials

- Bookkeeping & Automation

- Tips to do thing and that