Introduction

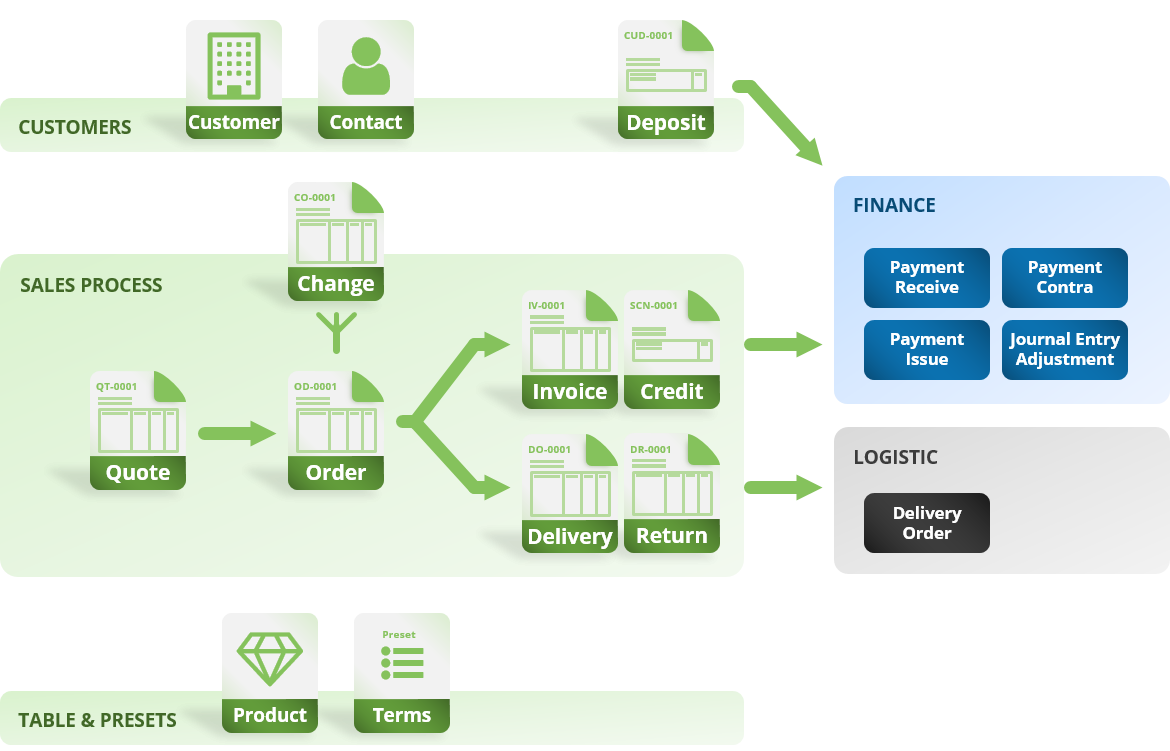

The Advance Order Management function allows businesses to handle complex real-world scenarios that may arise during the fulfilment of large orders that span over a period of months. This function provides the necessary tools to make adjustments to reflect changes in the order, such as releasing allocated stocks, issuing credit notes, and accepting delivery returns. This helps businesses to be more responsive to changes and ensure that the fulfilment of the order is carried out smoothly.

Features

Change Order

Change orders allow businesses to track and manage changes to a main sales order. This can include adding or subtracting items from the order, and the change order will automatically be aggregated with the main sales order to reflect the latest requirements. This helps ensure that the correct items and quantities are delivered to the customer and that only the correct amounts are billed. Any excess items can be returned and credited accordingly.

Products may not be necessary to be the same ask SKU, hence it can be configured to bundle multiple inventory SKUs or to have fixed specifications with variant options.

Credit Notes

Credit notes reduce the amount that a customer owes in a sales transaction. This may be necessary in cases where a customer has made an overpayment, received a discount, or made a double payment.

When use with Finance module, credit notes can be applied as payment on future invoices or refunded to the customer as an outbound payment. Debits work in reverse, adding to the amount due from a previous invoice.

Delivery Return

Delivery returns allow businesses to track and manage the return of goods that have been delivered. These goods can be restored to inventory, reclassified as a different group with different asset values, or disposed of as needed.

Highlights

Intuitive Change Management

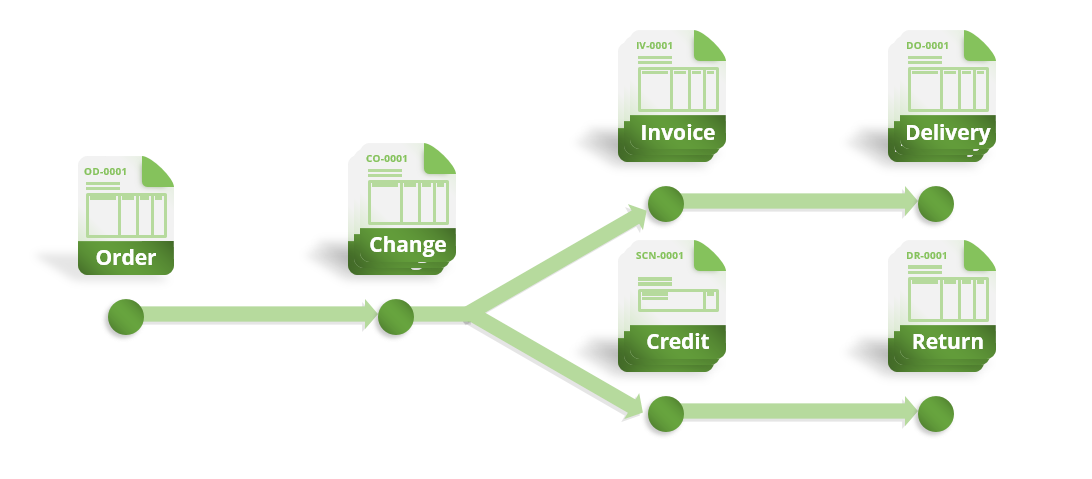

The Change Order feature is intuitive and easy to use, as it utilizes the same UI design as the sales order process. This means that there is no additional learning curve for users who are already familiar with the sales order process. The feature also allows for the release of excess reserved stocks back into the available inventory pool, ensuring that inventory is managed efficiently.

One of the key benefits of the Change Order feature is its ability to stack up multiple change orders as a historical record. This provides full transparency and access to past events, allowing users to easily understand and track changes to orders.

Overall, the seamless integration of the Change Order feature into the sales order process and its ability to manage inventory efficiently make it a valuable tool for any business

Processes

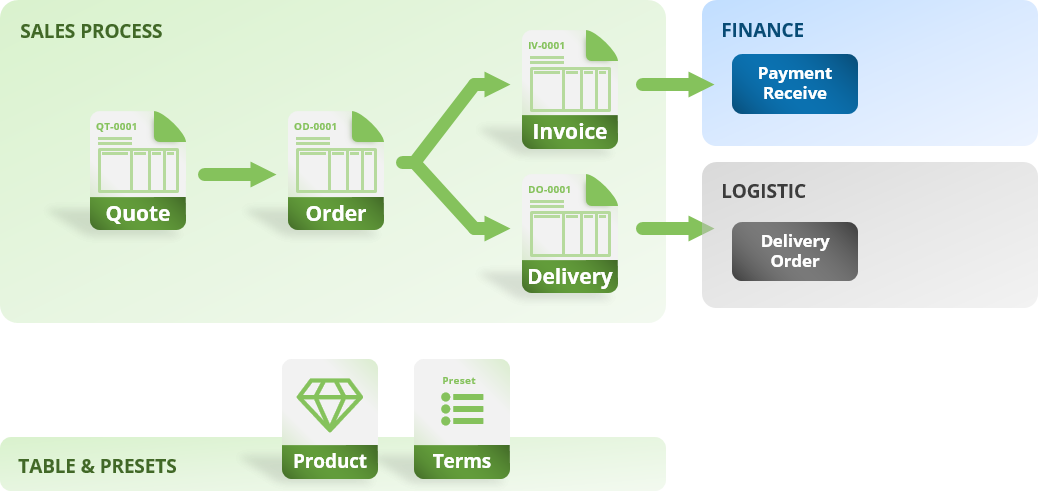

Order Processing with Change orders

The sales order allocation process begins when a customer places an order. The sales order is created and the necessary items are reserved from inventory. The customer may then request a change to the order, resulting in a change order being issued. The change order adjusts the quantity of items reserved from inventory and updates the sales order.

As the order is fulfilled, the customer may request additional changes or returns. These requests are recorded in additional change orders and may result in the issuance of delivery returns or credit notes. The sales order is updated to reflect these changes.

Finally, when the order is complete and all requested changes have been made, the invoice is generated and the customer is billed for the remaining balance. Any credit notes or returns are applied to the final invoice amount.

Credit Notes

A credit note is used when there is a reduction in the amount of an invoice, such as in the case of a discount or a return or refund. It is a document that records the excess amount of money that a customer has paid. Credit notes can be created from an existing invoice or under the sales module, and they contain information about the associated order, the customer, the line items, and the reason for the credit (such as overpayment, discount refund, or return/refund).

*This function requires subscription to Finance Module

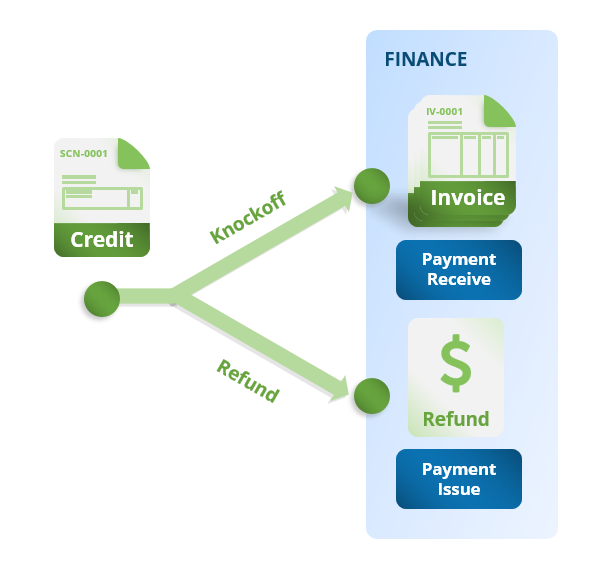

Once a credit note has been confirmed, the amount is posted to the account payable. From there, the credit note can be exercised in 3 ways: it can be used to knockoff future invoices, returned to the customer, or used to contra a vendor.

The deduction of a credit note is progressive, meaning that a large credit note can be used to knock off multiple invoices over time, and maybe the balance could then be return to customer.

Processes

Tours

- Bookkeeping & Automation

- Tips to do thing and that

Tutorials

- Bookkeeping & Automation

- Tips to do thing and that